Reinvestment strategy#

A reinvestment strategy creates an exposure to a single primary tradable stock instrument. In the SigTech platform, reinvestment strategies are instances of the ReinvestmentStrategy class, which can be used to handle corporate actions for underliers.

Inheriting from the DailyStrategy base class, ReinvestmentStrategy adjusts for corporate actions throughout the historical timeline of a strategy, including stock splits, takeovers, mergers, and spinoffs.

Environment#

Import Python libraries and initialize the SigTech framework environment:

import datetime as dtm

import numpy as np

import pandas as pd

import sigtech.framework as sig

env = sig.init()

Learn more: SigTech framework environment

Retrieve a primary tradable single stock object#

Define a function get_primary_tradable to:

Accept

mic, an exchange operating Market Identifier Code (MIC), andticker, a stock tickerFilter SigTech’s point-in-time stock data for matching records

Return a primary tradable single stock object

def get_primary_tradable(mic, ticker):

return env.sig_master()\

.filter_to_last_pit_record()\

.filter_primary_fungible()\

.filter_primary_tradable()\

.filter_operating_mic(operating_mics=mic)\

.filter_exchange_tickers(exchange_tickers=ticker)\

.to_single_stock()[f"{ticker}.{mic}"]

Learn more: For more information on finding stock tickers and filtering SigTech’s point-in-time stock data, see Single stocks.

Use the get_primary_tradable function to retrieve the primary tradable instrument for Apple stocks in the US:

Input:

stock_obj = get_primary_tradable("XNAS", "AAPL")

stock_obj

Output:

1000045.SINGLE_STOCK.TRADABLE <class 'sigtech.framework.instruments.equities.SingleStock'>[140232241122000]

Alternatively, use the sig.obj.get utility function to retrieve the SingleStock object by its object name:

Input:

ticker = "1000045.SINGLE_STOCK.TRADABLE"

stock_obj = sig.obj.get(ticker)

stock_obj

Output:

1000045.SINGLE_STOCK.TRADABLE <class 'sigtech.framework.instruments.equities.SingleStock'>[140232241122000]

Retrieve unadjusted price data#

Retrieve a single stock object’s unadjusted price series and plot the data:

stock_obj.history(field="LastPrice").plot()

The large drops in the instrument’s price correspond to stock splits. To get more detail, examine the corporate actions for the single stock instrument:

Input:

corporate_actions = sig.internal.equities.corporate_actions.corporate_actions

splits = [

ca for ca in stock_obj.corporate_actions()

if isinstance(ca, corporate_actions.StockSplit)

]

splits

Output:

[StockSplit(Stock Split on 2000-06-21),

StockSplit(Stock Split on 2005-02-28),

StockSplit(Stock Split on 2014-06-09),

StockSplit(Stock Split on 2020-08-31)]

Retrieve price data adjusted for corporate events#

To retrieve a single stock object’s historical price data, adjusted for specified corporate actions, use the object’s adjusted_price_history method.

The adjusted_price_history function gives the instrument’s price data when dividends are reinvested in the same instrument. You can specify how to handle special and regular dividends, and the associated tax. The method also adjusts for corporate events like stock splits, and incorporates these events into the price series.

Parameter |

Default |

Behavior |

|---|---|---|

|

None (Required) |

When |

|

None (Required) |

When |

|

|

When |

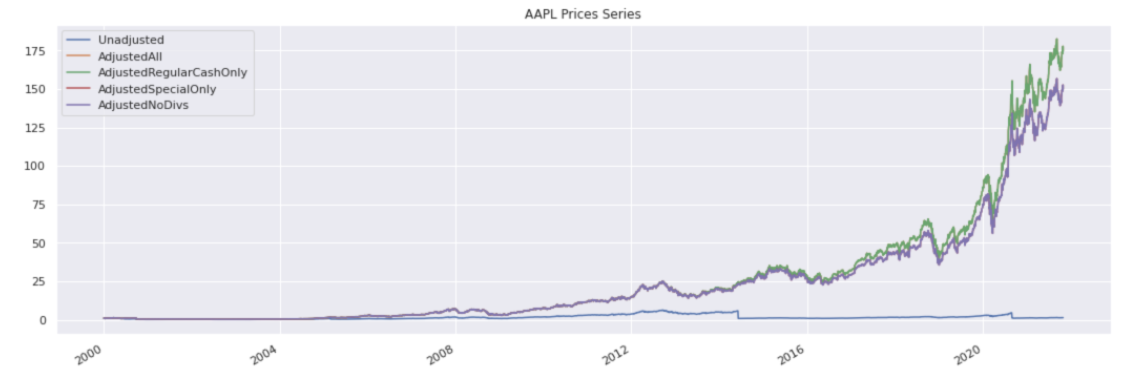

Example: AAPL#

aapl = get_primary_tradable("XNAS", "AAPL")

adjusted_data_aapl = pd.concat({

'Unadjusted': aapl.history(),

'AdjustedAll': aapl.adjusted_price_history(

adjust_regular_cash=True,

adjust_special_cash=True,

),

'AdjustedRegularOnly': aapl.adjusted_price_history(

adjust_regular_cash=True,

adjust_special_cash=False,

),

'AdjustedSpecialOnly': aapl.adjusted_price_history(

adjust_regular_cash=False,

adjust_special_cash=True,

),

'AdjustedNoDivs': aapl.adjusted_price_history(

adjust_regular_cash=False,

adjust_special_cash=False,

),

}, axis=1)

adjusted_data_aapl /= adjusted_data_aapl.iloc[0]

adjusted_data_aapl.plot(title="AAPL Prices Series")

In the data above, there are stock splits and regular cash dividends, but no special cash dividends. The stock splits are accounted for in the adjusted series data.

Example: TSLA#

tsla = get_primary_tradable("XNAS", "TSLA")

adjusted_data_tsla = pd.concat({

'Unadjusted': tsla.history(),

'AdjustedAll': tsla.adjusted_price_history(

adjust_regular_cash=True,

adjust_special_cash=True,

),

'AdjustedRegularOnly': tsla.adjusted_price_history(

adjust_regular_cash=True,

adjust_special_cash=False,

),

'AdjustedSpecialOnly': tsla.adjusted_price_history(

adjust_regular_cash=False,

adjust_special_cash=True,

),

'AdjustedNoDivs': tsla.adjusted_price_history(

adjust_regular_cash=False,

adjust_special_cash=False,

),

}, axis=1)

adjusted_data_tsla /= adjusted_data_tsla.iloc[0]

adjusted_data_tsla.plot(title="TSLA Prices Series")

As no dividends have been paid by TSLA, altering the input arguments to adjusted_price_history does not impact the resulting time series.

Create a reinvestment strategy#

A SigTech reinvestment strategy automatically handles corporate actions, using price data adjusted for corporate actions and reinvesting dividends, and optionally accounts for transaction costs.

The following example creates a reinvestment strategy using ReinvestmentStrategy. It takes the instrument’s string identifier/ticker AAPL_RS as an underlier parameter:

Input:

start_date = dtm.datetime(2018, 1, 1)

end_date = dtm.datetime(2024, 1, 1)

aapl_rs = sig.ReinvestmentStrategy(

start_date=start_date,

end_date=end_date,

currency=aapl.currency,

underlyer=aapl.name,

ticker=f"AAPL_RS",

)

aapl_rs

Output:

AAPL_RS STRATEGY <class 'sigtech.framework.strategies.reinvestment_strategy.ReinvestmentStrategy'>[140049016689296]

View the reinvestment strategy’s history data:

Input:

aapl_rs.history().tail()

Output:

2023-12-22 1543.380355

2023-12-26 1538.995709

2023-12-27 1539.792914

2023-12-28 1543.220903

2023-12-29 1534.850228

Name: (LastPrice, EOD, AAPL_RS STRATEGY), dtype: float64

The strategy’s trading days are determined by its holiday calendar. Retrieve the strategy’s holiday calendar:

Input:

aapl_cal_name = aapl_rs.underlyer_object.holidays()

aapl_cal = sig.obj.get(aapl_cal_name)

aapl_cal

Output:

'NYSE(T) CALENDAR'

About the ReinvestmentStrategy class#

The sig.ReinvestmentStrategy class inherits fields and methods from the Strategy class:

Input:

issubclass(sig.ReinvestmentStrategy, sig.Strategy)

Output:

True

Like all strategies, a reinvestment strategy has access to the plotting and analytics wrappers used by sig.Strategy:

Input:

plot_wrapper = aapl_rs.plot

plot_wrapper

Output:

<sigtech.framework.strategies.components.plot_wrapper.PlotWrapper at 0x7fd24ce10fd0>

Input:

analytics_wrapper = aapl_rs.analytics

analytics_wrapper

Output:

<sigtech.framework.strategies.components.analytics_wrapper.AnalyticsWrapper at 0x7fd24cee7bd0>

plot_wrapper.performance()

A reinvestment strategy also has access to properties defined on the parent class:

print(aapl_rs.direction)

print(aapl_rs.initial_cash)

print(aapl_rs.include_trading_costs)

print(aapl_rs.total_return)

You can use Strategy parameters when you create a reinvestment strategy:

aapl_rs_2 = sig.ReinvestmentStrategy(

start_date=start_date,

end_date=end_date,

currency=aapl.currency,

underlyer=aapl.name,

ticker=f"AAPL_RS",

include_trading_costs=True,

)

aapl_rs_2

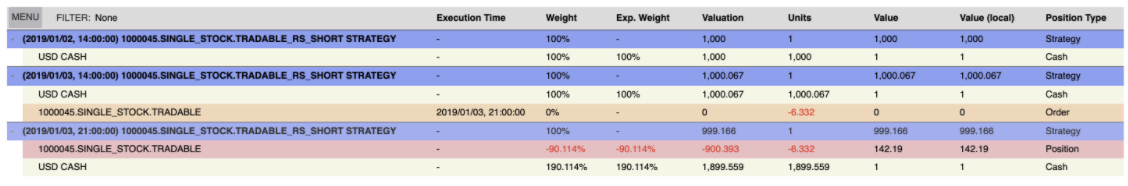

Strategy details and parameters#

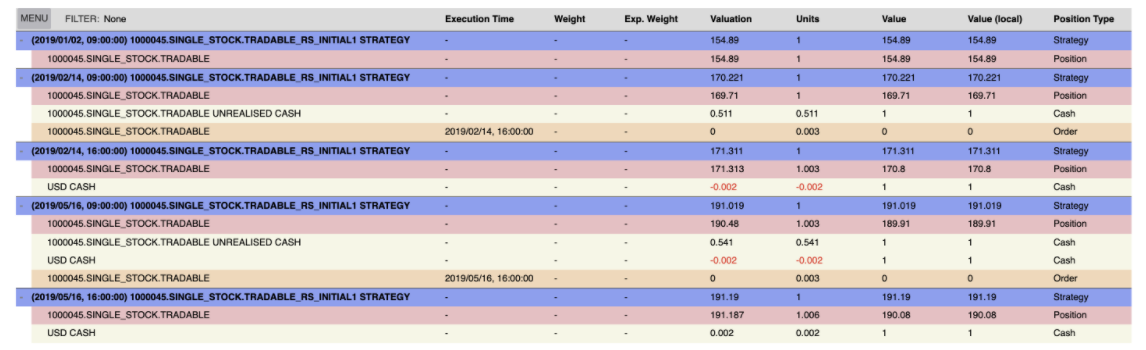

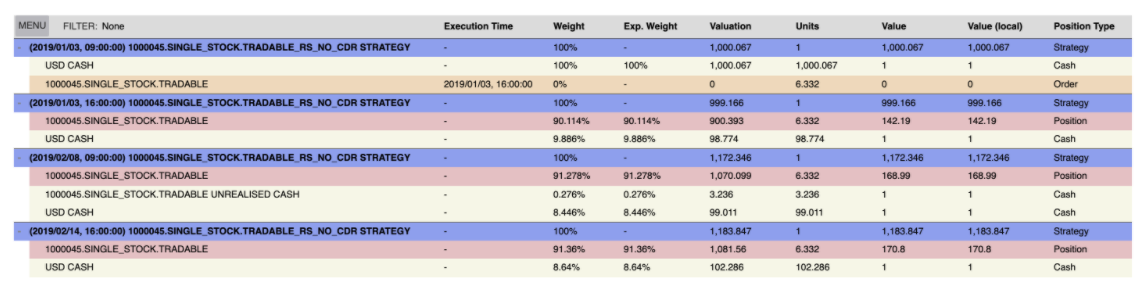

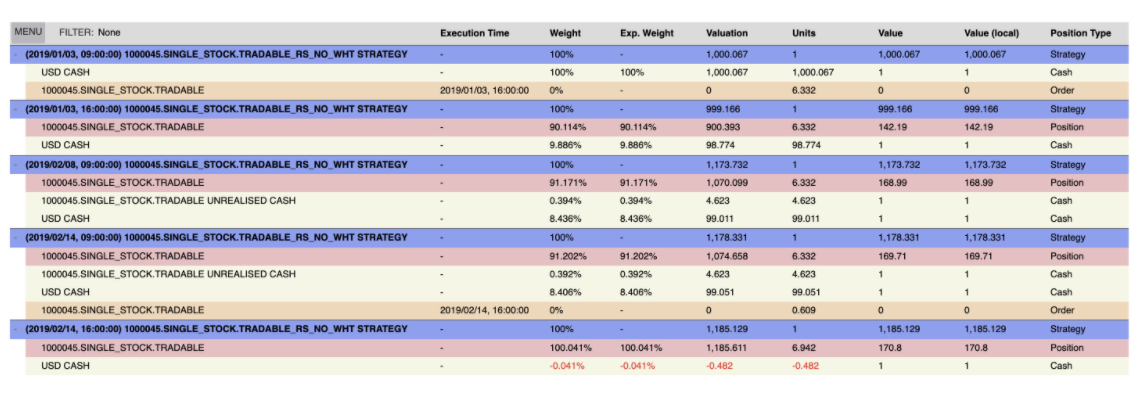

Analyzing the basic strategy at the level of TOP_POSITION_CHG_PTS:

Generation of an initial order on the underlying stock [2019/01/03, 09:00:00].

Execution of the initial order on the underlying stock [2019/01/03, 16:00:00].

Cash dividend going ex and being considered part of ‘UNREALISED CASH’ [2019/02/08, 09:00:00].

Generation of an order to reinvest dividends paid by the stock back into the stock [2019/02/14, 09:00:00].

Execution of the above order to reinvest dividend distribution [2019/02/14, 16:00:00].

To ensure that strategy action times are displayed locally, set timezone to be that of the security.

Note: The default timezone is UTC.

Input:

import pytz

local_timezone = pytz.timezone(stock_obj.exchange().timezone)

local_timezone.zone

Output:

'America/New_York'

start_date = dtm.datetime(2023, 1, 1, tzinfo=local_timezone)

aapl_rs.plot.portfolio_table(

dts="TOP_POSITION_CHG_PTS",

start_dt=start_date,

end_dt=start_date + dtm.timedelta(days=60),

tzinfo=local_timezone

)

Dividends#

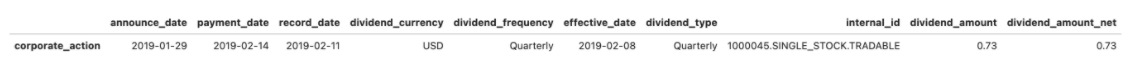

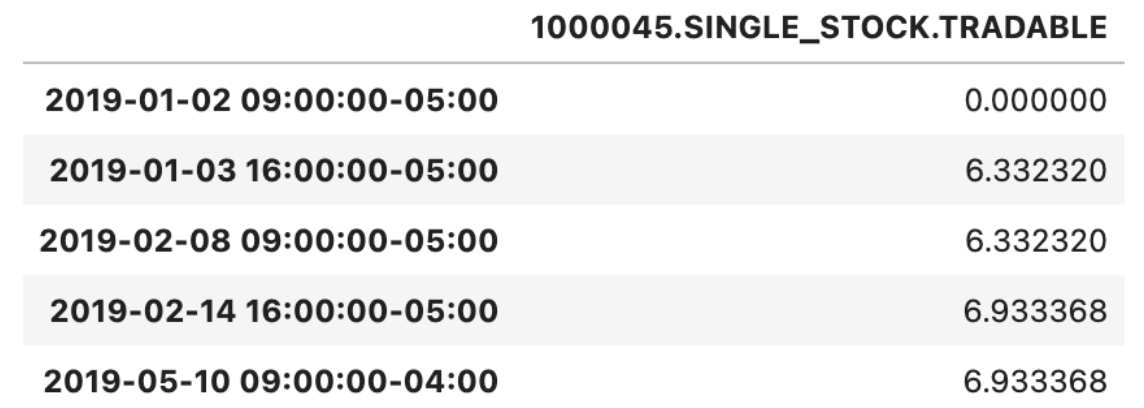

Continuing from the above outline, the position in 1000045.SINGLE_STOCK.TRADABLE UNREALISED CASH at [2019/02/14, 09:00:00] is dividend proceeds.

ca = aapl_rs.underlyer_object.corporate_actions()

first_dividend_effective_dtm = dtm.datetime(2019, 2, 8, 9, tzinfo=local_timezone)

dividend = [c for c in ca \

if c.effective_date == first_dividend_effective_dtm.date()][0]

dividend

Input:

print(f"Effective Date: {dividend.effective_date}")

print(f"Payment Date: {dividend.payment_date}")

Output:

Effective Date: 2019-02-08

Payment Date: 2019-02-14

Verify dividend cash calculation:

stock_position = aapl_rs.inspect.positions_df().tz_convert(local_timezone)

stock_position.head()

Input:

units = stock_position.loc[:first_dividend_effective_dtm].iloc[-1, 0]

print(f"Stock Units: {round(units, 3)}")

Output:

Stock units: 6.332

Input:

default_wht = 0.3 # default 30% withholding tax

dividend_cash = units * dividend.dividend_amount * (1 - default_wht)

print(f"Dividend Cash: {round(dividend_cash, 3)}")

Output:

Dividend cash: 3.236

Reinvesting cash dividends#

By default, dividends received are reinvested in the underlying stock. The parameter reinvest_cash_dividends provides you with control over this logic.

rs_no_cdr = sig.ReinvestmentStrategy(

start_date=start_date,

end_date=end_date,

currency=aapl.currency,

underlyer=aapl.name,

# specify no cash dividend reinvestment

reinvest_cash_dividends=False,

ticker=f"{aapl.name}_RS_NO_CDR"

)

rs_no_cdr.build()

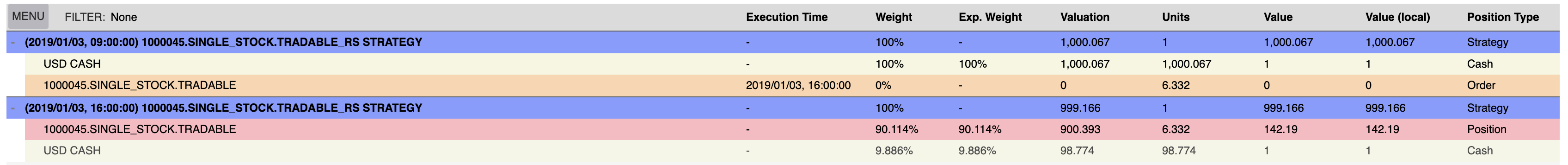

With this change, the order to reinvest cash from the dividend on 14th February has disappeared. Instead, the unrealized cash from the dividend effective date becomes part of realized ‘USD CASH’ on the dividend payment date.

rs_no_cdr.plot.portfolio_table(

dts="TOP_POSITION_CHG_PTS",

start_dt=start_date,

end_dt=start_date + dtm.timedelta(days=60),

tzinfo=local_timezone

)

Withholding tax rates#

Withholding tax (WHT) time series can be accessed from a stock object.

Input:

stock_obj.dividend_withholding_tax_ts()

Output:

1990-01-01 0.3

Name: Dividend Withholding Tax, dtype: float64

A particular WHT rate can be set by using the withholding_tax_override parameter.

Create an RS with no WHT:

rs_no_wht = sig.ReinvestmentStrategy(

start_date=start_date,

end_date=end_date,

currency=stock_obj.currency,

underlyer=aapl.name,

# specify no withholding tax rate

withholding_tax_override=0.0,

ticker=f"{aapl.name}_RS_NO_WHT"

)

rs_no_wht.build()

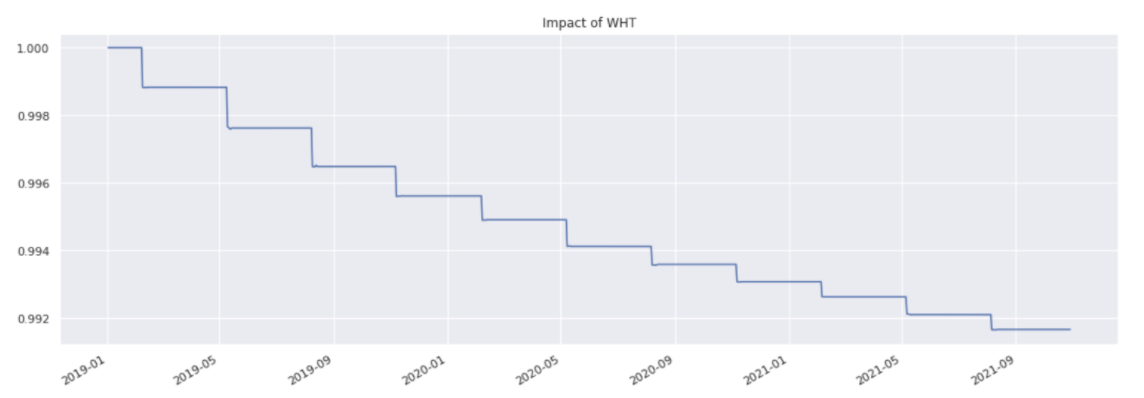

The following plot shows the ratio of the value of the RS with 30% WHT to the RHS with 0% WHT:

df = pd.concat({

"RS_WHT": aapl_rs.history(),

"RS_NO_WHT": rs_no_wht.history(),

}, axis=1)

df["RATIO"] = df["RS_WHT"] / df["RS_NO_WHT"]

df["RATIO"].plot(title="Impact of WHT")

rs_no_wht.plot.portfolio_table(

dts="TOP_POSITION_CHG_PTS",

start_dt=start_date,

end_dt=start_date + dtm.timedelta(days=60),

tzinfo=local_timezone

)

The jumps in ratio between the two versions of the RS occur on dividend effective dates.

Fetch regular cash dividends:

from sigtech.framework.internal.equities.corporate_actions.corporate_actions import RegularCashDividend

dividends = [

c for c in ca if isinstance(c, RegularCashDividend)

if c.payment_date >= dtm.date(2018,1,1)

]

ratio_changes = sorted(df.RATIO.pct_change().sort_values(). \

head(len(dividends)).index.tolist())

payment_dates = [c.effective_date for c in dividends \

if c.effective_date < dtm.date(2024,1,1)]

Tracking#

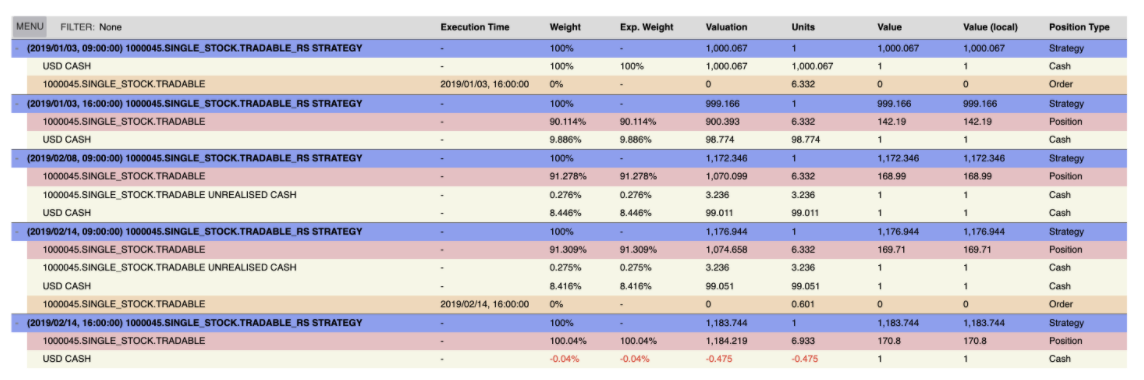

Revisiting the first Reinvestment Strategy created, the portfolio table shows that the initial position in stock is actually 90.114% [2019/01/03 16:00:00]:

aapl_rs.plot.portfolio_table(

dts="TOP_ORDER_PTS",

start_dt=start_date,

end_dt=start_date + dtm.timedelta(days=1),

tzinfo=local_timezone

)

The weight of an instrument held within a strategy, assuming the instrument is in the same currency as the strategy, can be computed as: (units_held * unit_price) / strategy_price

Check this calculation directly:

Input:

value_date = pd.Timestamp(2019, 1, 3)

rs_price = aapl_rs.valuation_price(value_date)

rs_price

Output:

999.1662739994936

Input:

stock_price = stock_obj.valuation_price(value_date)

stock_price

Output:

142.19001

Input:

stock_obj.history().loc[value_date]

Output:

142.19001

Input:

value_dt = aapl_rs.valuation_dt(value_date)

stock_units = stock_position.loc[:value_dt].iloc[-1, 0]

stock_units

Output:

6.332320162107397

Agreement with the above portfolio table:

Input:

print(

f"Stock Exposure: {round(100 * (stock_price * stock_units) / rs_price, 3)}%"

)

Output:

Stock Exposure: 90.114%

The reason this exposure does not exactly match the target exposure of 100% is that the sizing, or determination of the number of shares to trade, is done using the prior day’s close. This closely resembles the experience of a trader with access to End of Day (EOD) prices.

In most cases, the difference between target weight and realised weight would not be this large. In this particular case, AAPL experienced a large negative move on the day of execution (-9.96%).

Input:

100 * stock_obj.history().pct_change().loc[value_date]

Output:

-9.960733282674761

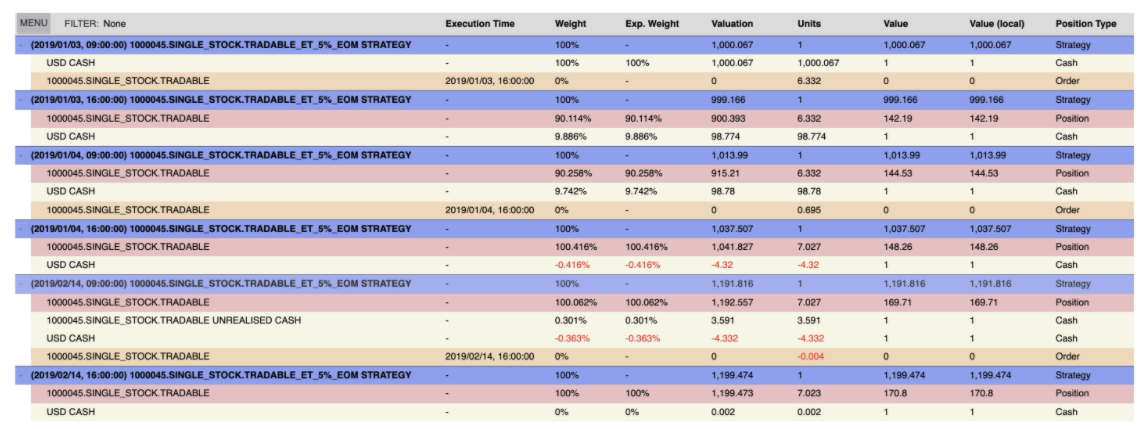

The enable_tracking parameter will cause an RS to trade toward full exposure on a schedule you provided (tracking_frequency, default SOM).

An optional tracking_threshold can also be set (default 1bp) that controls whether these tracking trades should be executed. For example, the threshold is 1%, the current exposure is 99.5%, so no action takes place.

rs_et = sig.ReinvestmentStrategy(

start_date=start_date,

end_date=end_date,

currency=stock_obj.currency,

underlyer=ticker,

# enable tracking

enable_tracking=True,

tracking_frequency="EOM",

tracking_threshold=0.05,

ticker=f"{ticker}_ET_5%_EOM",

)

rs_et.build()

An additional trade is now scheduled on 2019/01/04.

Since this brings the exposure to within the threshold of the target, no further trades are implemented until the dividend is reinvested in February.

rs_et.plot.portfolio_table(

dts="TOP_ORDER_PTS",

start_dt=start_date,

end_dt=start_date + dtm.timedelta(days=60),

tzinfo=local_timezone

)

Setting very low thresholds and a very regular threshold_frequency can impact performance.

Input:

rs_et_1bd = sig.ReinvestmentStrategy(

start_date=start_date,

end_date=end_date,

currency=stock_obj.currency,

underlyer=ticker,

enable_tracking=True,

tracking_frequency="1BD",

tracking_threshold=0.0001,

ticker=f"{ticker}_ET_1bp_1BD",

)

%time rs_et_1bd.build()

Output:

CPU times: user 734 ms, sys: 17 µs, total: 734 ms

Wall time: 732 ms

Input:

rs_et_1m = sig.ReinvestmentStrategy(

start_date=start_date,

end_date=end_date,

currency=stock_obj.currency,

underlyer=ticker,

enable_tracking=True,

tracking_frequency="EOM",

tracking_threshold=0.01,

ticker=f"{ticker}_ET_1%_EOM",

)

%time rs_et_1m.build()

Output:

CPU times: user 108 ms, sys: 8.76 ms, total: 117 ms

Wall time: 111 ms

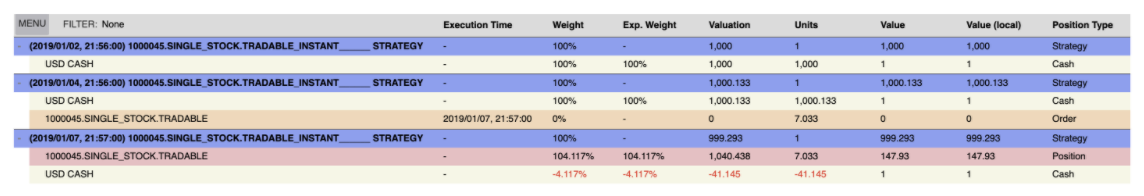

Overriding strategy execution time:

hours, minutes = 21, 56

decision_time = dtm.time(hours, minutes)

size_time = dtm.time(hours, minutes + 1)

execution_time = dtm.time(hours, minutes + 2)

Input:

decision_time

Output:

datetime.time(21, 56)

Input:

size_time

Output:

datetime.time(21, 57)

Input:

execution_time

Output:

datetime.time(21, 58)

local_zone = local_timezone.zone

rs_instant = sig.ReinvestmentStrategy(

start_date=start_date,

end_date=end_date,

currency=stock_obj.currency,

underlyer=ticker,

withholding_tax_override=0.0,

size_time_input=size_time,

decision_time_input=decision_time,

execution_time_input=size_time,

size_timezone_input=local_zone,

decision_timezone_input=local_zone,

execution_timezone_input=local_zone,

initial_shares=1,

initial_cash=100,

include_trading_costs=False,

total_return=False,

)

rs_instant.build()

rs_instant.plot.portfolio_table(

dts="TOP_ORDER_PTS",

start_dt=start_date,

end_dt=start_date + dtm.timedelta(days=10),

tzinfo=local_timezone

)

Trading out of stocks that will delist#

An example of a stock that was delisted due to bankruptcy:

Input:

delisted_stock_obj = sig.obj.get("1002181.SINGLE_STOCK.TRADABLE")

delisted_stock_obj.company_name

Output:

'EASTMAN KODAK'

Input:

delisted_stock_obj.expiry_date

Output:

datetime.date(2013, 8, 30)

Input:

delisted_stock_obj.delist_date

Output:

datetime.date(2013, 9, 3)

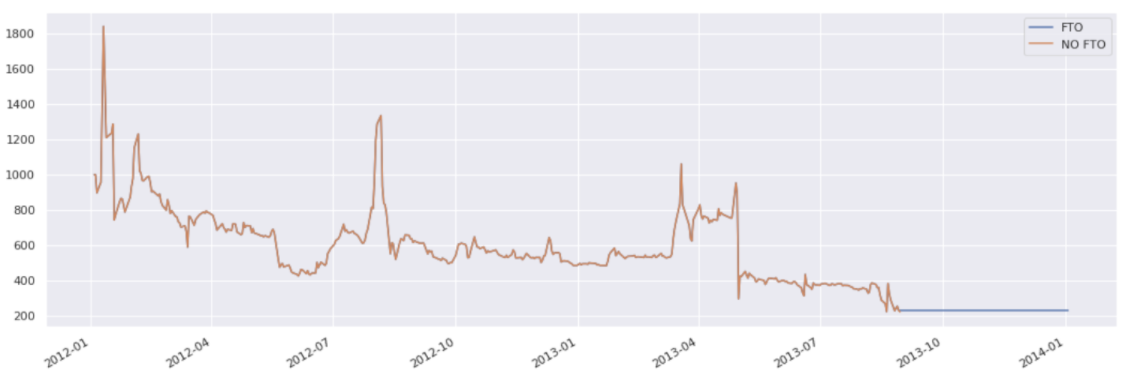

The final_trade_out parameter causes a Reinvestment Strategy to sell out of the underlying before it is delisted. The RS will then hold cash.

This can be very useful when another strategy, such as SignalStrategy, is trading a universe of RS. The onus will no longer be on you to ensure that no trades on the Reinvestment Strategy, corresponding to the delisted security, are initiated.

fto_start_date = dtm.date(2012, 1, 4)

fto_end_date = dtm.date(2014, 1, 4)

rs_no_fto = sig.ReinvestmentStrategy(

start_date=fto_start_date,

end_date=fto_end_date,

currency=delisted_stock_obj.currency,

underlyer=delisted_stock_obj.name,

ticker=f"{delisted_stock_obj.name}_NO_FTO",

)

rs_no_fto.build()

rs_fto = sig.ReinvestmentStrategy(

start_date=fto_start_date,

end_date=fto_end_date,

currency=delisted_stock_obj.currency,

underlyer=delisted_stock_obj.name,

# final trade out

final_trade_out=True,

ticker=f"{delisted_stock_obj.name}_FTO",

)

rs_fto.build()

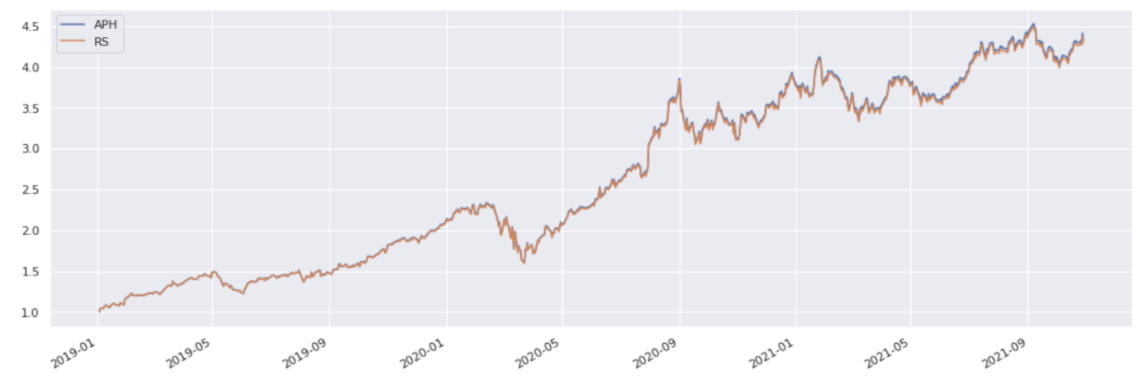

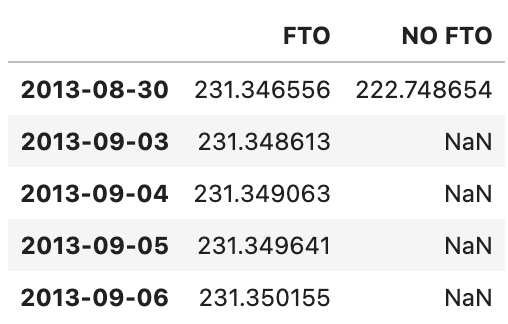

The version of the RS with final_trade_out set to False has NaN prices from the delisting date onward, rendering it impossible to trade, which includes the closing of positions in it. The version with final_trade_out set to True does not have this problem.

df = pd.concat({

"FTO": rs_fto.history(),

"NO FTO": rs_no_fto.history(),

}, axis=1)

df.loc[delisted_stock_obj.expiry_date:].head()

df.plot()

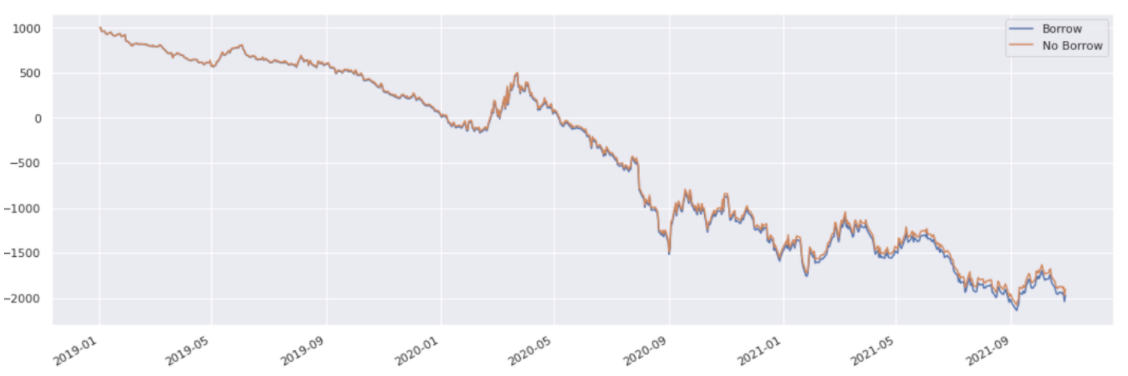

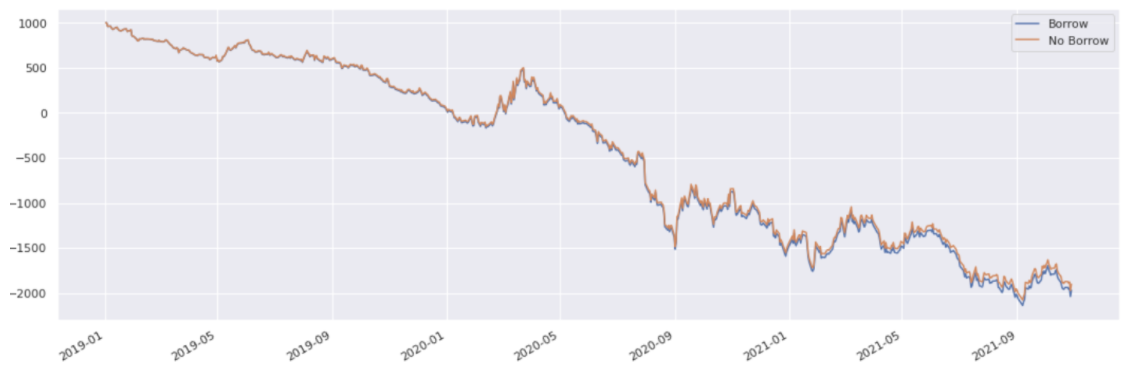

Borrow costs#

Shorting costs can be specified with the borrow_cost_ts parameter. The following example assumes there is no borrowing cost:

rs_short = sig.ReinvestmentStrategy(

start_date=start_date,

end_date=end_date,

currency=stock_obj.currency,

underlyer=ticker,

ticker=f"{ticker}_RS_SHORT",

# specific to shorting

direction="short",

# cash given opposite sign as we are short

initial_cash=-1000,

borrow_cost_ts=0,

# should not specify dividend reinvestment when short

reinvest_cash_dividends=False,

)

rs_short.build()

The following example uses a fixed annual cost of 1%:

Note: A time series could also be supplied.

rs_short_borrow = sig.ReinvestmentStrategy(

start_date=start_date,

end_date=end_date,

currency=stock_obj.currency,

underlyer=ticker,

ticker=f"{ticker}_RS_SHORT_BORROW",

# specific to shorting

direction="short",

# cash given opposite sign as we are short

initial_cash=-1000,

borrow_cost_ts=1,

# should not specify dividend reinvestment when short

reinvest_cash_dividends=False,

)

rs_short_borrow.build()

df = pd.concat({

"Borrow": rs_short_borrow.history(),

"No Borrow": rs_short.history(),

}, axis=1)

df.plot()

rs_short.plot.portfolio_table(

dts="TOP_ORDER_PTS"

)

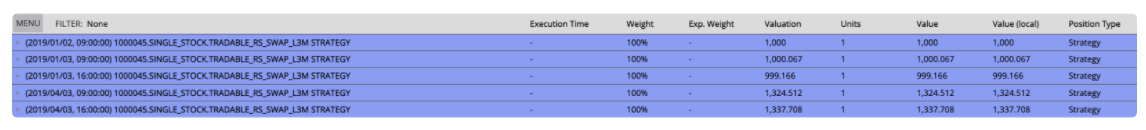

Trading in swap format#

Exposure to the underlying can also be obtained in swap format, with the relevant parameters being:

trade_swap_format: Equity traded as swap if set toTrue.swap_reset_frequency: Frequency at which swap is reset, which leads to margin cleanup.swap_include_financing: Financing, as determined by thelibor_instrument_nameandlibor_spreadparameters, is charged ifTrue.

rs_swap = sig.ReinvestmentStrategy(

start_date=start_date,

end_date=end_date,

currency=stock_obj.currency,

underlyer=ticker,

# swap specific parameters

trade_swap_format=True,

swap_reset_frequency='3M',

swap_include_financing=True,

reinvest_cash_dividends=False,

libor_instrument_name='US0003M INDEX',

libor_spread=0.001,

ticker=f'{ticker}_RS_SWAP_L3M',

)

rs_swap.build()

rs_swap.plot.portfolio_table(

dts='TOP_ORDER_PTS',

end_dt=dtm.date(2019, 4, 4),

tzinfo=local_timezone

)

Comparing the ReinvestmentStrategy and Strategy classes#

Note: This section is optional reading.

By comparing the data_dict of an RS with its parent class, Strategy, we can see which of its arguments are unique to this building block.

Create a general Strategy object:

general_strategy = sig.Strategy(

start_date=start_date,

end_date=end_date,

currency=stock_obj.currency

)

Access elements of the RS data_dict that are not present in the data_dict of a generic Strategy:

Input:

rs_only_keys = sorted([

key for key in aapl_rs.data_dict()

if key not in general_strategy.data_dict()

])

rs_only_keys

Output:

['borrow_cost_ts',

'corporate_actions_take_up_voluntary',

'enable_tracking', 'final_trade_out',

'initial_shares', 'libor_instrument_name',

'libor_spread', 'net_dividend_override',

'rebalance_bdc',

'rebalance_offset',

'rebalance_offset_sticky_end',

'reinvest_cash_dividends',

'spinoff_receive_cash',

'swap_include_financing',

'swap_reset_frequency',

'tracking_frequency',

'tracking_threshold',

'trade_swap_format',

'underlyer',

'underlyer_type',

'universe_filters',

'use_substrats',

'withholding_tax_override']