Strategy#

The Strategy class is the basis for all backtesting in the SigTech platform. Functionality embedded within the Strategy class is also accessible via the classes inheriting from it.

Since all building blocks inherit from Strategy, using the full functionality of the SigTech platform’s building blocks requires a familiarity with the base class.

This page is relevant to all users of the SigTech platform—learn how to:

Build and backtest a strategy: Plot the value of a strategy through time.

Name a strategy: Specify a name for a strategy via the ticker parameter.

Retrieve a strategy: Fetch strategy objects from your cache via the

sig.obj.getAPI.Clone a strategy: Create a copy of a strategy and change its parameters.

Fix the parameters of a strategy: Set the initial cash held by a strategy, determine if that cash accrues interest, and decide whether or not transaction costs are included in the backtest.

Agenda#

Environment#

Set up your environment using the following three steps:

Import the relevant internal and external libraries

Configure the environment parameters

Initialise the environment

import pandas as pd

import datetime as dtm

from uuid import uuid4

import seaborn as sns

sns.set(rc={'figure.figsize': (18, 6)})

import sigtech.framework as sig

currency = 'USD'

start_date = dtm.date(2020, 1, 2)

end_date = dtm.date(2021, 11, 30)

sig.init(env_date=end_date)

Learn more: setting up the environment.

Backtesting#

Backtests are conducted by creating an instance of an object that inherits from the Strategy class and calling build on it.

The following code block cycles through some commonly used building blocks and checks that they inherit from Strategy:

Input:

example_building_blocks = [

sig.RollingFutureStrategy,

sig.RollingFXForwardStrategy,

sig.DynamicOptionsStrategy,

sig.RollingSwapStrategy,

sig.ReinvestmentStrategy,

sig.RollingBondStrategy,

sig.BasketStrategy,

sig.SignalStrategy,

]

for building_block in example_building_blocks:

print(f'{building_block.__name__}: {issubclass(building_block, sig.Strategy)}')

Output:

RollingFutureStrategy: True

RollingFXForwardStrategy: True

DynamicOptionsStrategy: True

RollingSwapStrategy: True

ReinvestmentStrategy: True

RollingBondStrategy: True

BasketStrategy: True

SignalStrategy: True

Once a strategy has been built, the details of the backtest are stored within it and are accessible for further analysis. This includes the value of the strategy and holdings through time, and lower level details, such as the generation and execution of orders.

Note: calling build on a strategy that has already been built has no additional effect.

The following instance of a RollingFutureStrategy object is an example:

Note: strategies generally require a currency and start_date. If an end_date isn’t used, the asofdate for the configured environment is used.

rfs = sig.RollingFutureStrategy(

currency=currency,

start_date=start_date,

contract_code='ES',

contract_sector='INDEX',

)

Working through the build cycle:

Input:

rfs.built

Output:

False

rfs.build()

Input:

rfs.built

Output:

True

Once a strategy has been built, calling history retrieves a pd.Series of its values or prices:

Note: this is the equivalent of calling history on an instrument to return its value through time.

Input:

rfs.history().head()

Output:

2020-01-02 1000.000000

2020-01-03 999.992522

2020-01-06 1002.576428

2020-01-07 1000.088143

2020-01-08 1007.802267

Name: (LastPrice, EOD, USD ES INDEX LONG NONE 4C2AE1C5 RFS STRATEGY), dtype: float64

Tip: it is unnecessary to call build and history separately. Calling history on an unbuilt strategy calls build automatically.

Strategy tickers#

When a strategy object is constructed you can assign a name to it, using the ticker parameter. Once constructed, it is added to the cache of the environment.

If a ticker is not provided on construction, the strategy name is determined using the strategy details:

Strategy type: such as

SforStrategyorBSforBasketStrategy.Currency.

A random, eight-digit, alphanumeric combination.

To create a Strategy and display its automatically generated name:

Input:

s = sig.Strategy(

currency=currency,

start_date=start_date,

end_date=end_date

)

s.name

Output:

'USD 16454872 S STRATEGY'

To create a Strategy called TEST STRATEGY:

Input:

t = sig.Strategy(

currency=currency,

start_date=start_date,

end_date=end_date,

ticker='test'

)

t.name

Output:

'TEST STRATEGY'

Note: strategy names are always written in upper case, withSTRATEGYadded to the end.

In Backtesting, we built a RollingFutureStrategy called rfs. But we did not assign a ticker value. To display the automatically generated name of rfs:

Input:

rfs.name

Output:

'USD ES INDEX LONG NONE 4C2AE1C5 RFS STRATEGY'

Cache#

When a strategy object is created, its name is added to the cache. You can access the cache directly via the configured environment:

env_cache = sig.env().object.cache

Any object that has been accessed is also added to the cache. We can check the size of the cache with the following call:

Input:

print(len(env_cache))

Output:

135

You can filter the objects in the cache for those whose name ends with STRATEGY:

Input:

sorted([o for o in env_cache.keys() if o.endswith('STRATEGY')])

Output:

['TEST STRATEGY',

'USD 16454872 S STRATEGY',

'USD CASH STRATEGY',

'USD ES INDEX LONG NONE 4C2AE1C5 RFS STRATEGY']

Note: The results of the previous two cells will vary at different points as you progress through the notebook and add more items to the cache.

Any object listed in the cache is retrieved using the sig.obj.get API. This includes strategies created by users:

Input:

test_strategy = sig.obj.get('TEST STRATEGY')

test_strategy

Output:

TEST STRATEGY <class 'sigtech.framework.strategies.strategy.Strategy'>[139995990091088]

Check this with the original version:

Input:

test_strategy == t

Output:

True

Examples#

To rebuild rfs and specify a ticker:

Input:

rfs_ticker = sig.RollingFutureStrategy(

currency=currency,

start_date=start_date,

contract_code='ES',

contract_sector='INDEX',

# specify ticker upon construction

ticker='ES RFS'

)

rfs_ticker.name

Output:

'ES RFS STRATEGY'

Object name clashes result in an ObjectError, unless the new strategy has identical characteristics to the existing strategy.

In the following code block, despite rfs_duplicate having the same ticker as rfs_ticker, there is no ObjectError as the characteristics of both strategies are identical:

Input:

rfs_duplicate = sig.RollingFutureStrategy(

currency=currency,

start_date=start_date,

contract_code='ES',

contract_sector='INDEX',

ticker='ES RFS'

)

rfs_duplicate.name

Output:

'ES RFS STRATEGY'

In contrast, the following example displays an error being produced due to rfs_error and rfs_ticker sharing the same ticker, but not the same start_date:

Input:

from sigtech.framework.internal.infra.utils.exceptions import ObjectError

try:

rfs_error = sig.RollingFutureStrategy(

currency=currency,

# start date is altered

start_date=start_date + dtm.timedelta(days=1),

contract_code='ES',

contract_sector='INDEX',

ticker='ES RFS'

)

except ObjectError as e:

print(e)

Output:

Creating new object contradicting existing one!

ES RFS STRATEGY <class 'sigtech.framework.strategies.rolling_future_strategy.RollingFutureStrategy'>[139995990168784]

ES RFS STRATEGY <class 'sigtech.framework.strategies.rolling_future_strategy.RollingFutureStrategy'>[139995990128336]

Cloning strategies#

The clone_strategy method allows you to create a copy of an existing strategy and vary some of its parameters.

A dictionary of {parameter: new_value} pairs should be supplied. The following example creates a version of rfs in 'EUR' with an updated ticker:

Input:

eur_rfs = rfs.clone_strategy({'currency': 'EUR', 'ticker': 'EUR RFS'})

eur_rfs

Output:

EUR RFS STRATEGY <class 'sigtech.framework.strategies.rolling_future_strategy.RollingFutureStrategy'>[139995990170832]

Input:

print(f'Currency: {eur_rfs.currency}')

print(f'Name: {eur_rfs.name}')

Output:

Currency: EUR

Name: EUR RFS STRATEGY

Strategy details and parameters#

Initial cash holdings#

A strategy begins by holding a number of cash units, denominated in the currency of the strategy. The number of units is determined by the initial_cash parameter, with a default value of 1000.

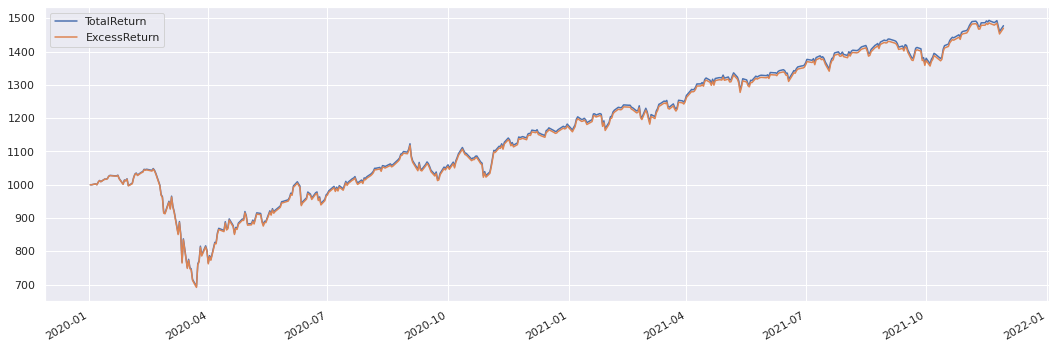

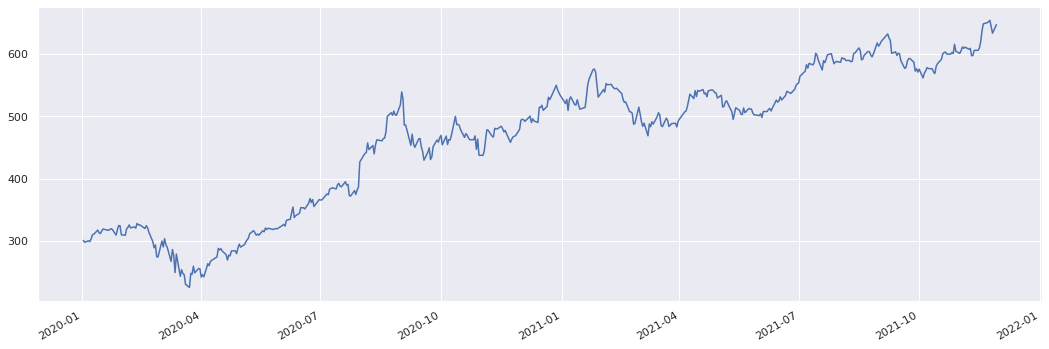

Using the RollingFutureStrategy in Backtesting, plotting the history of rfs results in an initial value of 1000:

rfs.history().plot();

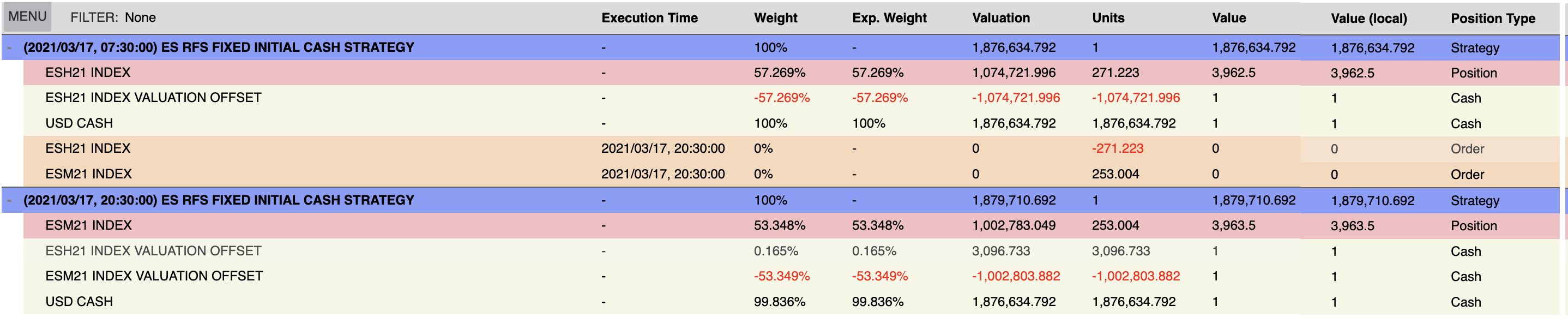

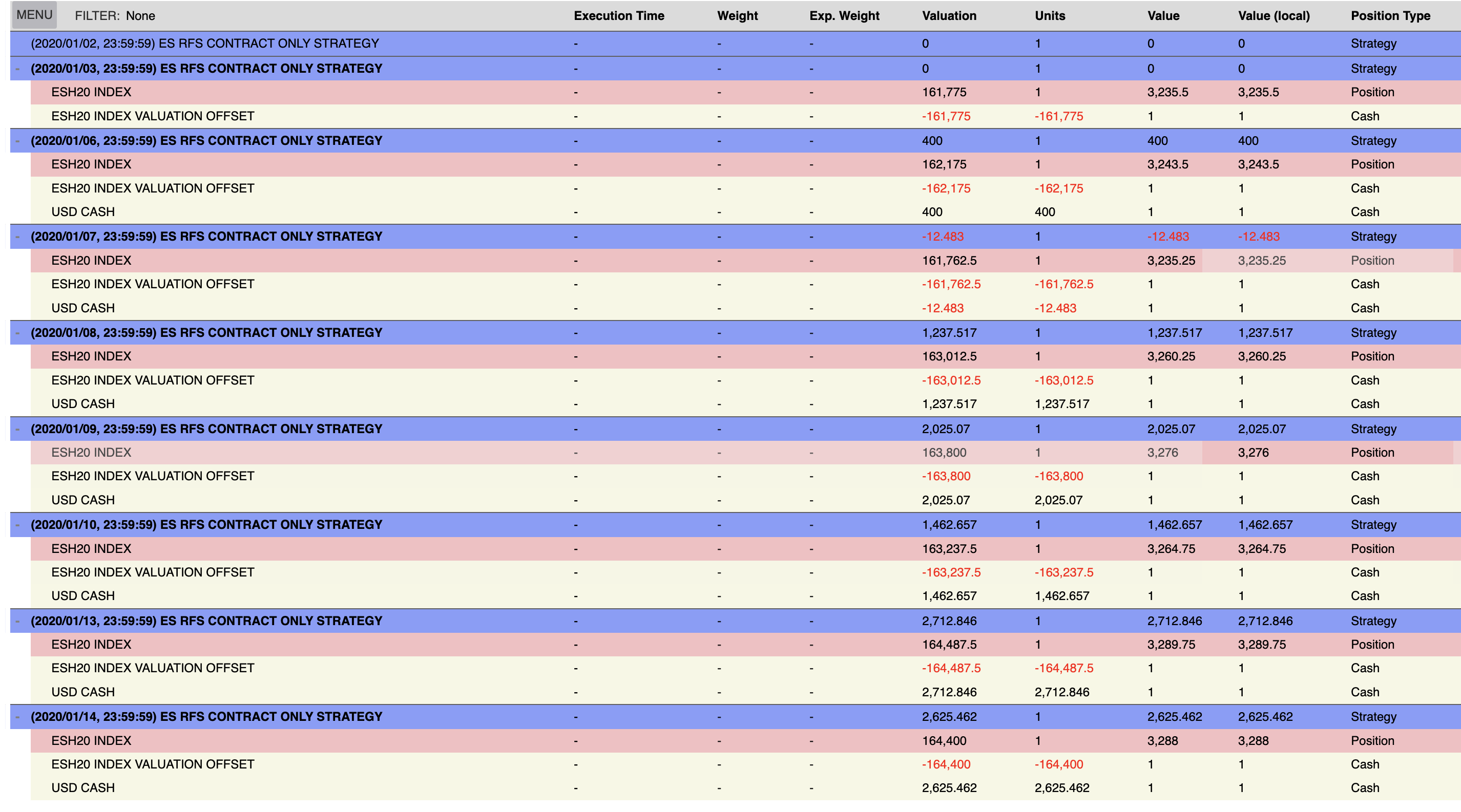

The portfolio table also records an initial 1000 units of USD CASH:

rfs.plot.portfolio_table(

dts='TOP_ORDER_PTS',

end_dt=dtm.date(2020, 1, 3)

)

To create a variant of rfs whose initial_cash level is 100:

Input:

rfs_initial_cash = rfs.clone_strategy({'ticker':'ES RFS $100', 'initial_cash': 100})

rfs_initial_cash.name

Output:

'ES RFS $100 STRATEGY'

As expected, the history series begins at 100:

Input:

rfs_initial_cash.history().head()

Output:

2020-01-02 100.000000

2020-01-03 99.999252

2020-01-06 100.257643

2020-01-07 100.008814

2020-01-08 100.780227

Name: (LastPrice, EOD, ES RFS $100 STRATEGY), dtype: float64

Assuming that the transaction cost model is AUM independent, varying initial_cash in this way is purely a matter of scaling and will not impact performance characteristics:

Input:

from sigtech.framework.analytics.performance.metrics import annualised_return

rfs_perf = annualised_return(rfs.history().dropna())

rfs_ic_perf = annualised_return(rfs_initial_cash.history().dropna())

print(f'{round(100 * rfs_perf, 3)}%')

print(f'{round(100 * rfs_ic_perf, 3)}%')

Output:

22.723%

22.723%

An exception to this rule is when initial_cash is set to zero. In this case no positions are opened. It is not possible to compute common metrics, such as return, for such a strategy.

Input:

rfs_zero_cash = rfs.clone_strategy({'ticker':'ES RFS ZERO', 'initial_cash': 0})

rfs_zero_cash.name

Output:

'ES RFS ZERO STRATEGY'

rfs_zero_cash.history().plot();

There are multiple ways to remove cash from a strategy whilst still investing in underlyings. In the case of the RollingFutureStrategy, you will need to provide a fixed_contracts parameter and set the initial_cash to zero.

Similar functionality is available for ReinvestmentStrategy objects, using the initial_shares parameter.

Learn more: examples of these cases are provided in Further examples.

Total return#

Accruing interest on the cash held within a strategy is optional and can be controlled with the boolean input total_return.

To create a variant of rfs that does not accrue interest on cash held:

rfs_er = rfs.clone_strategy({'ticker':'ES RFS ER', 'total_return': False})

rfs_er.build()

df = pd.DataFrame({'TotalReturn': rfs.history(),

'ExcessReturn': rfs_er.history()}).dropna()

df.plot();

The difference in annualised return between the TotalReturn version of the strategy and the ExcessReturn version is approximately 32 basis points:

Input:

round(10000 * (rfs_perf - annualised_return(df['ExcessReturn'])))

Output:

32.0

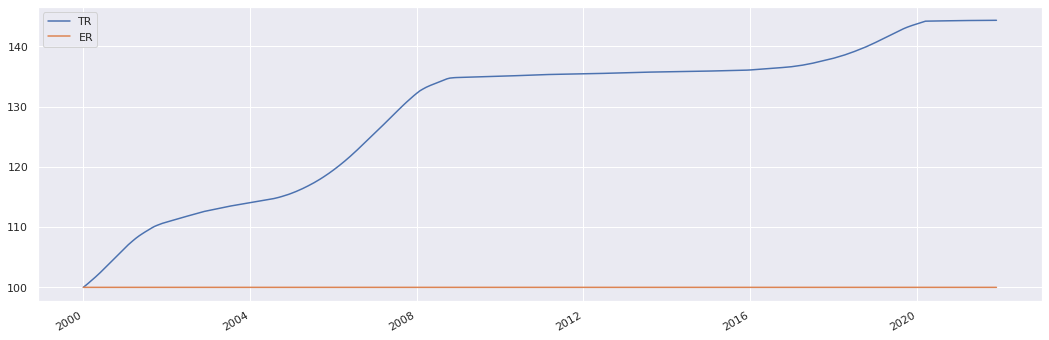

As a further example, a custom strategy that simply holds its initial cash is created:

class ExampleStrategy(sig.Strategy):

def strategy_initialization(self, dt):

pass

example_strategy = ExampleStrategy(

currency=currency,

start_date=dtm.date(2000, 1, 4),

initial_cash=100

)

To create an alternative version with total_return set to False and plot the performance of both versions of the strategy:

er_example_strategy = example_strategy.clone_strategy({

'total_return': False

})

pd.DataFrame({

'TR': example_strategy.history(),

'ER': er_example_strategy.history()

}).plot();

To switch off total_return at the global level when configuring the environment, use the command: sig.env()[sig.config.EXCESS_RETURN_ONLY] = True.

Learn more: Setting up your environment.

Transaction costs#

The inclusion of transaction costs in a backtest can be controlled with the include_trading_costs parameter.

You can create a variant of rfs that does not assume any trading costs:

rfs_no_tc = rfs.clone_strategy({

'ticker': 'RFS NO TRADING COSTS',

'include_trading_costs': False

})

To compute the impact of the transaction cost assumptions, you can compare the performance of the two strategy variants:

rfs_no_tc_perf = annualised_return(rfs_no_tc.history().dropna())

The impact here is 2bp annualised. This can vary considerably, depending on the underlying and the transaction cost model.

Learn more: Transaction costs - TradePricer

Input:

round(10000 * (rfs_no_tc_perf - rfs_perf))

Output:

2.0

To switch off transaction costs at the global level when configuring the environment, use the following command: sig.env()[sig.config.IGNORE_T_COSTS] = True.

Learn more: Setting up your environment.

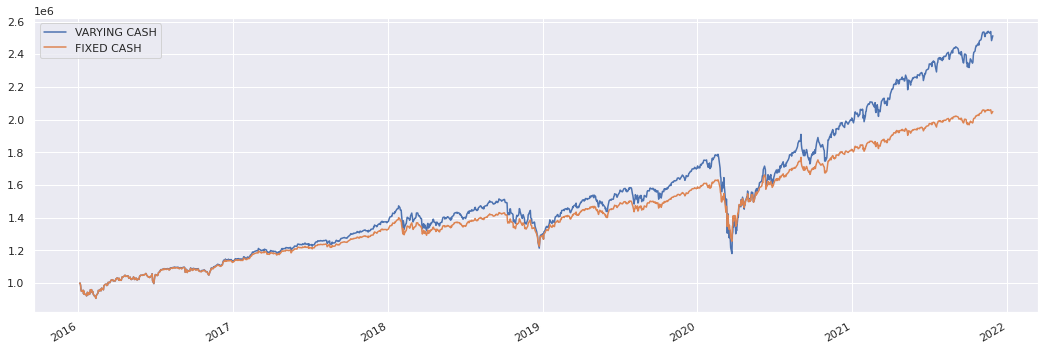

Not reinvesting P and L#

You can fix the amount of cash used to determine the position of a strategy at its inception.

Example: signify a fixed capital allocation for a PM regardless of performance.

rfs_initial = sig.RollingFutureStrategy(

currency=currency,

start_date=dtm.date(2016, 1, 4),

contract_code='ES',

contract_sector='INDEX',

# relevant parameters

initial_cash=1e6,

set_weight_from_initial_cash=True,

ticker='ES RFS FIXED INITIAL CASH'

)

rfs_initial.build()

rfs_varying = rfs_initial.clone_strategy({

'set_weight_from_initial_cash': False

})

pd.DataFrame({

'VARYING CASH': rfs_varying.history(),

'FIXED CASH': rfs_initial.history()

}).plot();

The following portfolio table displays a position of USD 1MM targeted at rebalance, despite the strategy holding close to USD 2MM in cash:

rfs_initial.plot.portfolio_table(

dts='TOP_ORDER_PTS',

start_dt=dtm.date(2021, 3, 1),

end_dt=dtm.date(2021, 4, 1)

)

Long and short positions#

Short versions of strategies are created by passing the direction parameter with a value of 'short', as opposed to its default of 'long':

rfs_short = sig.RollingFutureStrategy(

currency=currency,

start_date=start_date,

contract_code='ES',

contract_sector='INDEX',

# specify 'short' version

direction='short'

)

rfs_short.build()

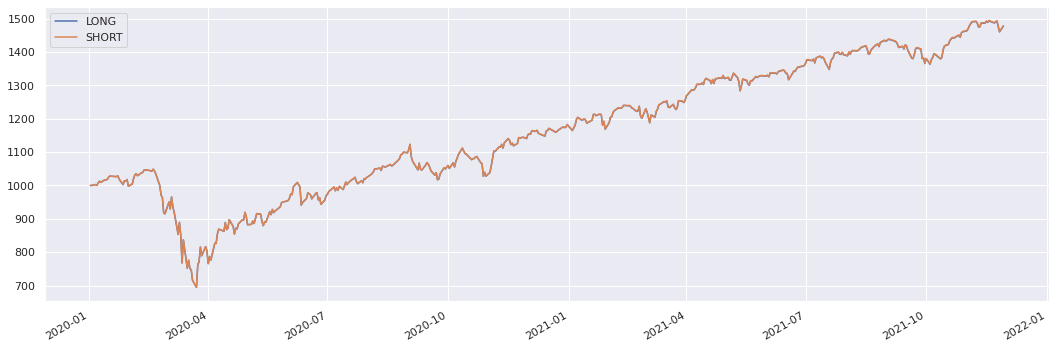

In the case of a RollingFutureStrategy, the 'short' version coincides with the negative of the long version:

pd.DataFrame({

'LONG': rfs.history(),

'SHORT': -rfs_short.history()

}).plot();

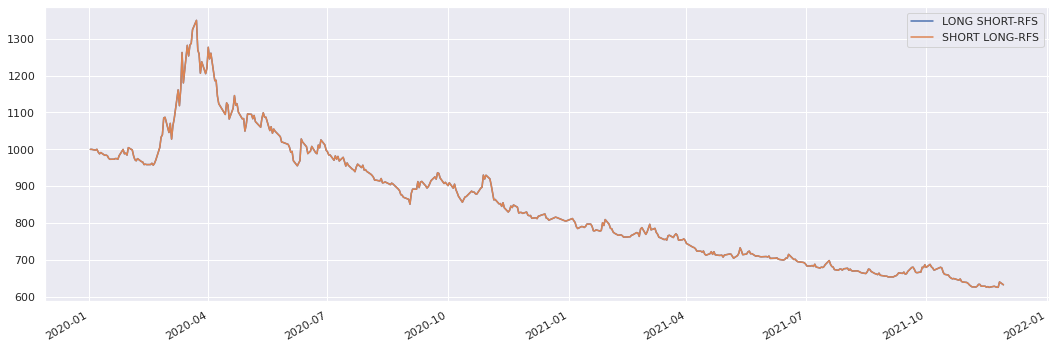

Going short on the long version of the RollingFutureStrategy through a basket delivers the same result as going long on the short version of the RollingFutureStrategy through a basket:

basket_short_long_rfs = sig.BasketStrategy(

currency=currency,

start_date=start_date,

end_date=end_date,

weights=[-1.0],

constituent_names=[rfs.name],

rebalance_frequency='EOM'

)

basket_short_long_rfs.build()

basket_long_short_rfs = sig.BasketStrategy(

currency=currency,

start_date=start_date,

end_date=end_date,

weights=[1.0],

constituent_names=[rfs_short.name],

rebalance_frequency='EOM'

)

basket_long_short_rfs.build()

pd.DataFrame({

'LONG SHORT-RFS': basket_long_short_rfs.history(),

'SHORT LONG-RFS': basket_short_long_rfs.history(),

}).plot();

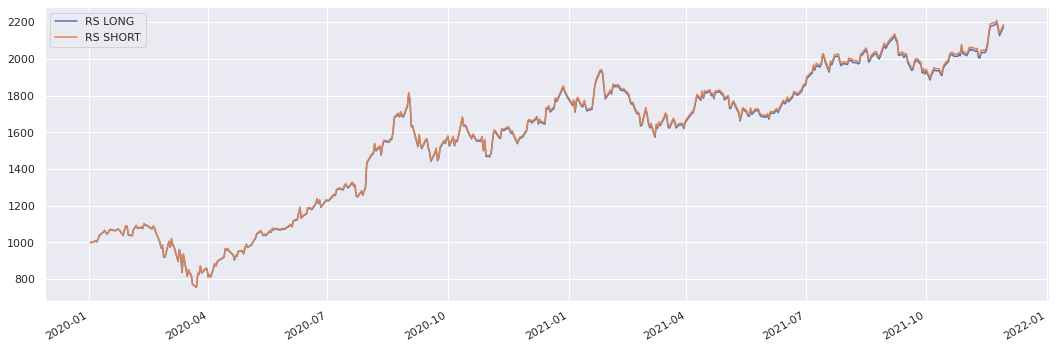

For certain assets there are expected differences caused by market realities. An example is the treatment of dividends when creating a ReinvestmentStrategy:

rs_long = sig.ReinvestmentStrategy(

currency=currency,

start_date=start_date,

end_date=end_date,

underlyer='1000045.SINGLE_STOCK.TRADABLE',

ticker='AAPL RS LONG'

)

rs_long.build()

rs_short = rs_long.clone_strategy({'direction': 'short'})

pd.DataFrame({

'RS LONG': rs_long.history(),

'RS SHORT': -rs_short.history()

}).plot();

Further examples#

Note: These examples illustrate how to specify a specific number of units of underlying to trade whilst using a Building Block wrapper. The precise syntax can vary by asset class.

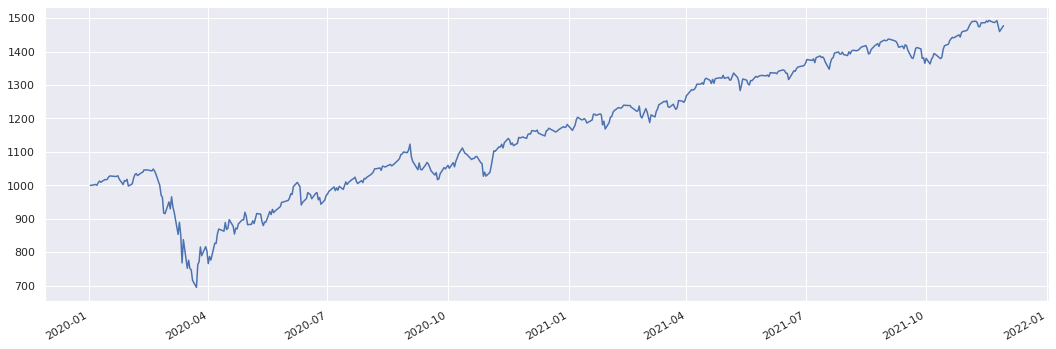

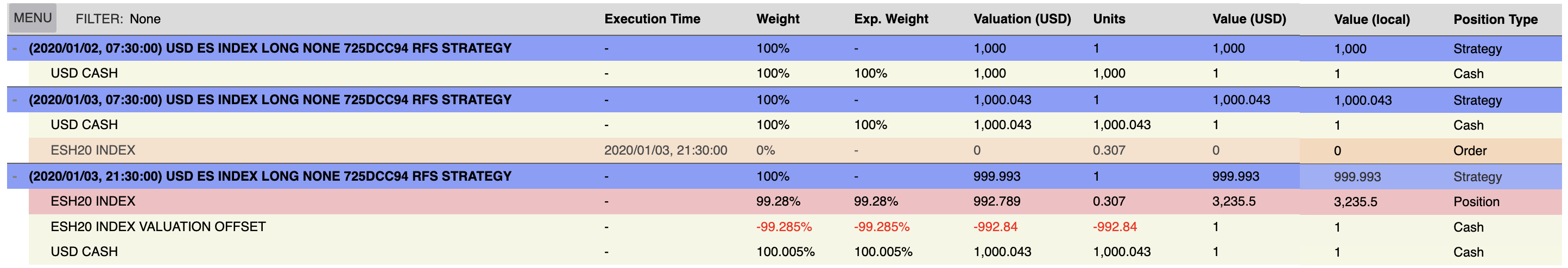

Rolling Future Strategy#

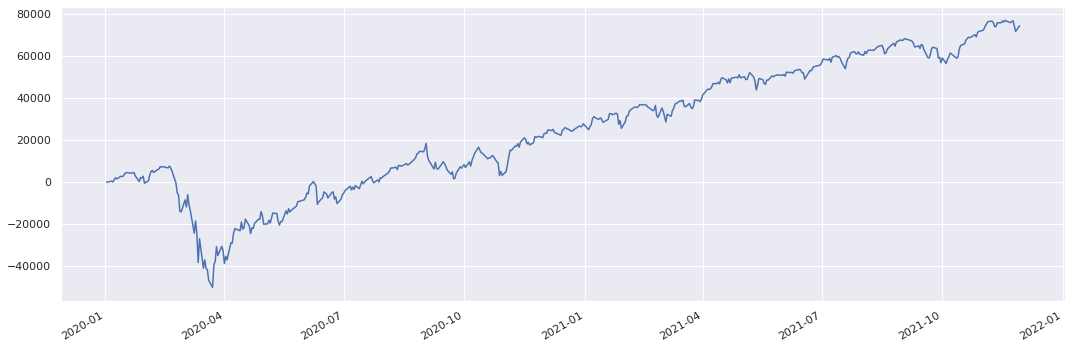

By default the number of contracts held by a RollingFutureStrategy will be determined by the strategy’s value and the value of each futures contract. It is possible to specify that a fixed number of contracts be traded by using the fixed_contracts parameter.

Input:

rfs_ticker = sig.RollingFutureStrategy(

currency=currency,

start_date=start_date,

contract_code='ES',

contract_sector='INDEX',

ticker='ES RFS'

)

rfs_ticker.name

Output:

'ES RFS STRATEGY'

rfs_contract_only = sig.RollingFutureStrategy(

currency=currency,

start_date=start_date,

end_date=end_date,

contract_code='ES',

contract_sector='INDEX',

# specific parameters

initial_cash=0,

include_trading_costs=False,

fixed_contracts=1,

ticker='ES RFS CONTRACT ONLY'

)

rfs_contract_only.build()

rfs_contract_only.history().plot();

rfs_contract_only.plot.portfolio_table(

dts='VALUATION_PTS',

start_dt=start_date,

end_dt=dtm.date(2020, 1, 14),

unit_type='TRADE'

)

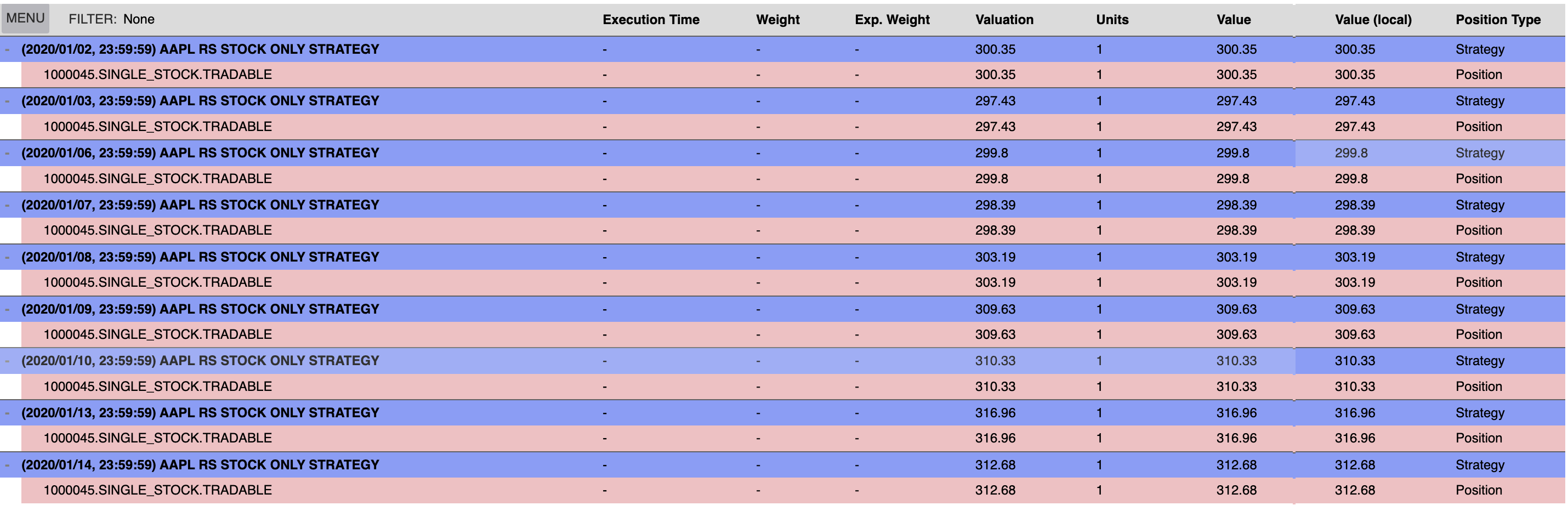

Reinvestment Strategy#

To create a ReinvestmentStrategy that holds precisely one unit of the underlying stock the initial_shares parameter can be used. You can also choose whether to include an initial cash balance on the strategy.

rs = sig.ReinvestmentStrategy(

currency=currency,

start_date=start_date,

end_date=end_date,

underlyer='1000045.SINGLE_STOCK.TRADABLE',

# specific parameters

initial_cash=0,

include_trading_costs=False,

initial_shares=1,

ticker='AAPL RS STOCK ONLY'

)

rs.build()

rs.history().plot();

rs.plot.portfolio_table(

dts='VALUATION_PTS',

start_dt=start_date,

end_dt=dtm.date(2020, 1, 14),

unit_type='TRADE'

)