Default strategies#

This page shows the default strategies that are available within the framework. The strategy objects are intended to speed up the process of strategy creation as common strategies can be called with a single line of code.

Note: the default strategies described in this section are unrelated to the example notebooks which can be access in the research environment. For more information, see Example notebooks.

Available default strategies#

Example use of default strategies #

Setting up your environment takes three steps:

Import the relevant internal and external libraries

Configure the environment parameters

Initialise the environment

import sigtech.framework as sig

import datetime as dtm

import seaborn as sns

sns.set(rc={'figure.figsize':(18,6)})

sig.config.init();

Learn more: setting up the environment.

To use a default strategy within the platform, they must be imported. An example for RollingFutureStrategy default strategies is shown here:

from sigtech.framework.default_strategy_objects.rolling_futures import *

The following example shows how these default strategies are used to create a simple BasketStrategy object of several RollingFutureStrategy objects:

assets = {

'Treasury Futures (TY)': ty_comdty_front().name,

'Corn Futures (C)': c_comdty_f_0().name,

'Soybean Futures (S)': s_comdty_f_0().name,

'Sugar Futures (SB)': sb_comdty_f_0().name,

'Cotton Futures (CT)': ct_comdty_f_0().name,

'Live Cattle Futures (LC)': lc_comdty_f_0().name,

'Soybean Oil Futures (BO)': bo_comdty_f_0().name,

'Brent Crude Futures (CO)': co_comdty_f_0().name,

'Gas Oil Futures (QS)': qs_comdty_f_0().name,

'Heating Oil Futures (HO)': ho_comdty_f_0().name,

'S&P Futures (ES)': es_index_front().name,

'Nasdaq Futures (NQ)': nq_index_front().name

}

Input:

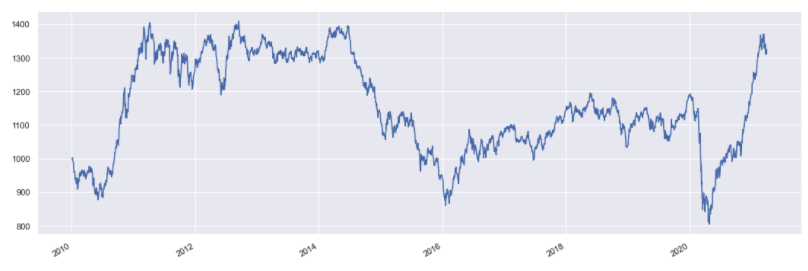

sig.BasketStrategy(

constituent_names = assets.values(),

start_date = dtm.date(2010, 1, 4),

currency = 'USD',

weights = [1 / len(assets.values())] * len(assets.values()),

rebalance_frequency = '1M'

).history().plot()

Output: