Beta hedging#

This page shows the construction of a beta hedge for strategies built on the SigTech platform. A beta hedge serves to offset the volatility associated with trading a financial instrument or portfolio.

Environment#

Begin by setting up your environment:

import pandas as pd

import seaborn as sns

from uuid import uuid4

import sigtech.framework as sig

sns.set(rc={'figure.figsize': (18, 6)})

sig.init()

Learn more: Setting up your environment

Simple example#

Rolling beta#

The following example demonstrates how to use a rolling ES SP500 futures strategy as a beta hedge for a rolling NQ Nasdaq futures strategy.

Start by importing ES and NQ default rolling futures strategies, and then build them:

from sigtech.framework.default_strategy_objects.rolling_futures \

import es_index_front, nq_index_front

nq_rfs = nq_index_front()

es_rfs = es_index_front()

nq_rfs.build()

es_rfs.build()

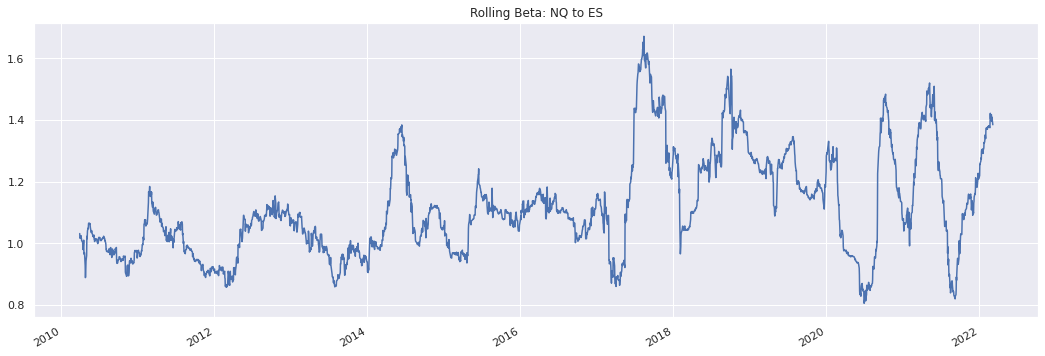

Use the rolling_beta method from the SigTech signal_library to compute the rolling beta of nq_rfs to es_rfs. The rolling window is set to 60 days:

window = 60

beta = sig.signal_library.core.rolling_beta(

ts=nq_rfs.history(), market_ts=es_rfs.history(), window=window

).dropna()

beta.plot(title='Rolling Beta: NQ to ES');

As expected, the beta of NQ to ES is mostly above 1. This is due to the higher level of volatility generally associated with NQ.

Hedging with the signal strategy#

Once the rolling beta exposure is computed, create a signal that assigns 1.0 to the strategy to be hedged, nq_rfs, and − beta to the hedging instrument, es_rfs.

signal = pd.DataFrame.from_dict({

nq_rfs.name: 1.0,

es_rfs.name: - beta

})

Combine this signal with the SignalStrategy building block to create a beta hedged version of a strategy:

def get_hedged_strategy(signal, freq):

strategy = sig.SignalStrategy(

signal_name=sig.signal_library.core.from_ts(signal).name,

start_date=signal.first_valid_index(),

currency='USD',

rebalance_frequency=freq,

ticker=f'BetaHedgedStrategy_{freq}_{str(uuid4())[:4]}'

)

strategy.build()

return strategy

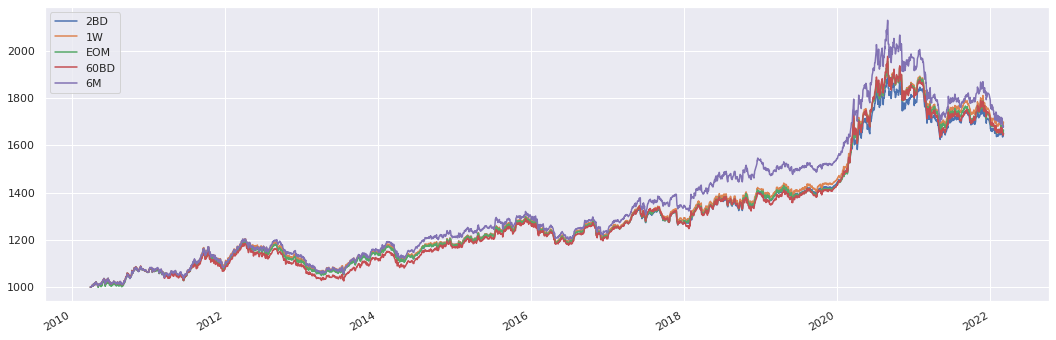

Impact of the beta estimation window#

To examine the impact of the rebalancing frequency on the hedged strategy:

frequencies = ['2BD', '1W', 'EOM', '60BD', '6M']

bh_strategies = {freq: get_hedged_strategy(signal, freq) for freq in frequencies}

strategy_histories = pd.concat(

{f: s.history() for f, s in bh_strategies.items()}, axis=1)

strategy_histories.plot();

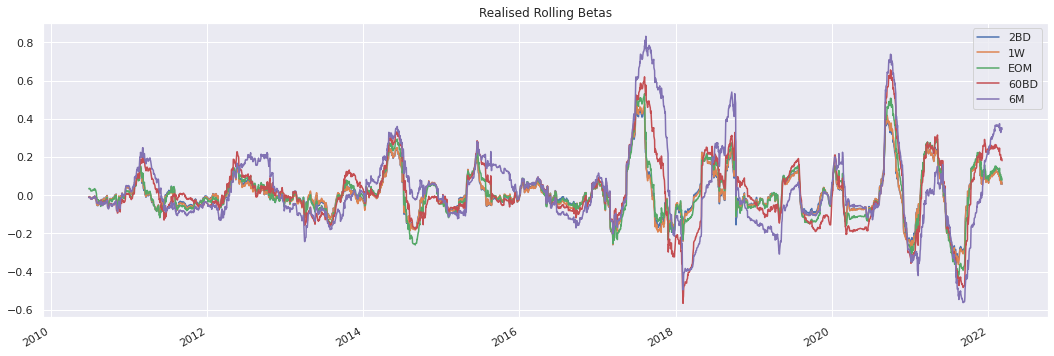

Realised beta#

The following code block measures the impact of the realised beta on the hedged strategy. As expected, more frequent rebalancing tends to decrease the magnitude of the realised beta:

realised_betas = {}

for f, s in bh_strategies.items():

realised_betas[f] = sig.signal_library.core.rolling_beta(

ts=s.history(), market_ts=es_rfs.history(), window=window

).dropna()

pd.DataFrame(realised_betas).plot(title='Realised Rolling Betas');