Parameter analysis#

This page shows how one might go about varying parameters in a strategy, and calculate the resulting Sharpe from each of the parameter runs.

The example is based around simple momentum and mean reversion strategies on the NY Harbor Heating Oil (HO COMDTY) Rolling Future Strategy.

Learn more: Example notebooks

Environment#

This section will import relevant internal and external libraries, as well as setting up the platform environment.

Learn more: Environment setup

import sigtech.framework as sig

from sigtech.framework.analytics.performance.metrics import sharpe_ratio

import datetime as dtm

import pandas as pd

import numpy as np

import seaborn as sns

import matplotlib.pyplot as plt

sns.set(rc={'figure.figsize': (18, 6)})

if not sig.config.is_initialised():

sig.config.init()

sig.config.set(sig.config.HISTORY_SCHEDULE_BUILD_FROM_DATA, True)

Momentum: varying window length #

A RollingFutureStrategy object of the NY Harbor Heating Oil contract is created:

Learn more: Rolling Future Strategy

ho_rf_usd_strat = sig.RollingFutureStrategy(

currency='USD',

start_date=dtm.date(2010, 1, 4),

contract_code='HO',

contract_sector='COMDTY',

rolling_rule='F_0',

monthly_roll_days='1:10'

)

Define a function to construct a momentum strategy with a custom window length:

@sig.remote

def momentum_strategy_sharpe(underlying_obj_name: str, window_length: int):

''' Constructs a SMA-based momentum strategy with a given window length.'''

# Get return

signal_ts = sig.obj.get(underlying_obj_name).history().diff(window_length)

# Create df with column name equal to underlying object name

signal_ts = pd.DataFrame({underlying_obj_name: signal_ts})

# Get sign of returns

signal_ts = np.sign(signal_ts).dropna()

# Create signal object, can be passed around between researchers

signal_obj = sig.signal_library.from_ts(signal_ts)

signal_strategy = sig.SignalStrategy(

start_date=dtm.date(2010, 1, 4),

currency='USD',

signal_name=signal_obj.name,

rebalance_frequency='EOM',

allocation_function=sig.signal_library.allocation.identity,

leverage=1,

)

return sharpe_ratio(signal_strategy.history())

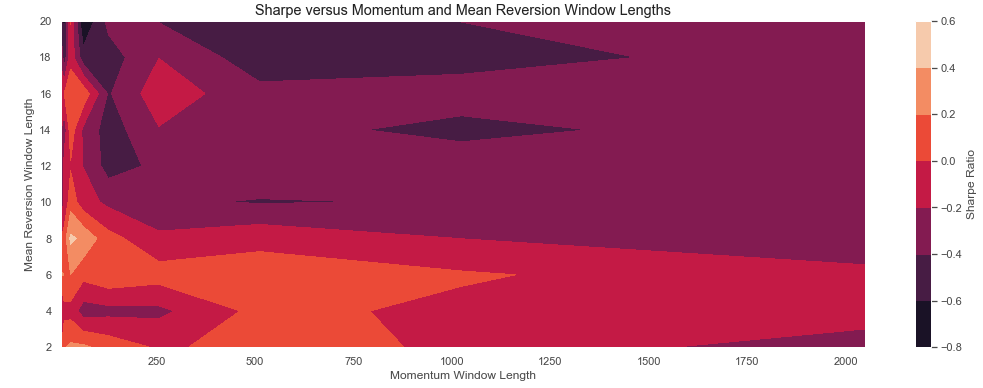

Use this function to construct a number of strategies and plot their Sharpe ratios:

plt.style.use('ggplot')

# Generate window lengths as powers of 2

x = [2 ** i for i in range(3, 12)]

# Generate resulting Sharpe ratios

ho_rf_usd_strat.build()

y = sig.calc_remote([momentum_strategy_sharpe(ho_rf_usd_strat.name, w) for w in x])

# Plot results and annotate chart

fig, ax = plt.subplots()

ax.scatter(x, y)

ax.set_title('Sharpe versus Momentum Window Length')

ax.set_xlabel('Momentum Window Length')

ax.set_ylabel('Strategy Sharpe')

ax.axhline(y=0., linestyle='--');

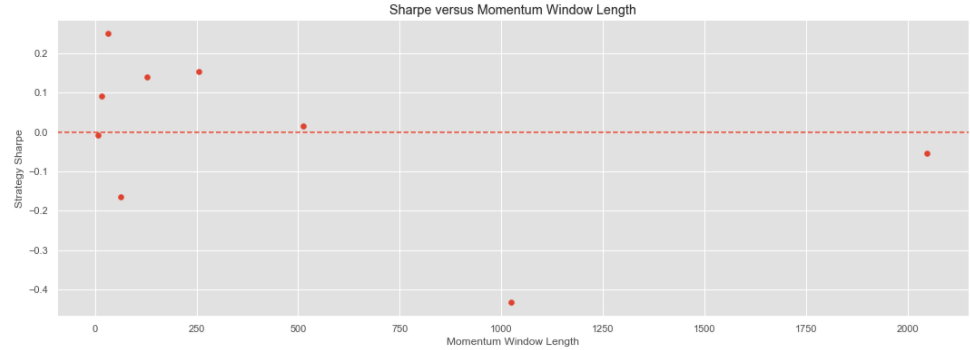

Momentum and Mean Reversion: varying window lengths #

A 2D surface from varying both Momentum and Mean Reversion windows is created in the following example.

First, define a function to calculate the Sharpe for a combined Momentum and Mean Reversion strategy:

@sig.remote

def mmr_strategy_sharpe(

underlying_obj_name: str,

momentum_window_length: int,

meanrev_window_length: int):

""" Constructs a combined Momentum and Mean Reversion strategy on a given underlying. """

# Identical lengths of windows will cancel out, ignore them

if momentum_window_length == meanrev_window_length:

return 0.

# Get history of underlyer

obj_history = sig.obj.get(underlying_obj_name).history()

# Create momentum and mean reversion signals and combine them

signal_momentum = obj_history.pct_change().rolling(

window=momentum_window_length).mean()

signal_meanrev = -obj_history.pct_change().rolling(window=meanrev_window_length).mean()

signal_ts = signal_momentum + signal_meanrev

# Create df with column name equal to underlying object name

signal_ts = pd.DataFrame({underlying_obj_name: signal_ts})

# Get sign of returns

signal_ts = np.sign(signal_ts).dropna()

# Create signal object, can be passed around between researchers

signal_obj = sig.signal_library.from_ts(signal_ts)

strategy = sig.SignalStrategy(

start_date=dtm.date(2010, 1, 4),

currency='USD',

signal_name=signal_obj.name,

rebalance_frequency='EOM',

allocation_function=sig.signal_library.allocation.identity,

leverage=1,

)

return sharpe_ratio(strategy.history())

Then use this function to construct a number of strategies and plot their Sharpe ratios on a 2D plot:

# Generate window lengths in specific ranges

mom_ws = [2 ** i for i in range(3, 12)]

mr_ws = range(2, 21, 2)

# Generate resulting Sharpe ratios in a 2D array

sharpes = sig.calc_remote(

[

mmr_strategy_sharpe(

underlying_obj_name=ho_rf_usd_strat.name,

momentum_window_length=w1,

meanrev_window_length=w2

)

for w2 in mr_ws for w1 in mom_ws

]

)

z = np.matrix(np.array(sharpes).reshape(len(mr_ws), len(mom_ws)))

# Plot results and annotate chart

fig, ax = plt.subplots()

plot = ax.contourf(mom_ws, mr_ws, z)

ax.set_title('Sharpe versus Momentum and Mean Reversion Window Lengths')

ax.set_xlabel('Momentum Window Length')

ax.set_ylabel('Mean Reversion Window Length')

cbar = fig.colorbar(plot, ax=ax)

cbar.ax.set_ylabel('Sharpe Ratio');